Six emerging business models in EV landscape-India

This disruption in the automotive value chain in India due to electrification creates several opportunities for investors and new entrants. Existing players still reside in these pools, but several new and relatively uncontested niches will open up over the next few years:

1: Battery manufacturing, packaging, and BMS

The Indian EV industry today is heavily dependent on imported batteries. vehicles However, the

is a push to localize large parts of the battery value chain and add domestic value. This is partly due to the government’s localization goals and incentives, which open

Opportunities for new players to participate:

- Cellular production is capital-intensive, complex, and requires deep global connections to supply raw materials. As a result, most of the global mobile network is concentrated in China, Korea, and Japan is likely to localize India’s cell supply by 2030. It will be powered by the $2.3 billion PLI system to store

- Advanced chemical cell batteries, with a target of 50 GWh of cumulative domestic capacity per year over the next five years.

- Players like Reliance New Energy, Ola Electric, and Rajesh Exports are already using this scheme.

- Local investment in battery and BMS development under Indian conditions meets

- Localization goals and increases government incentives. While some of this investment is for existing battery manufacturers and OEMs,

There is an opportunity for independent players to participate.

2: EV Components

High demand for local EV-specific components has created opportunities for component

suppliers. For example, in sub-segments such as mechatronics, production in

is already 50–60% localized. Similarly, the outsourcing of engines and engine controls by OEMs and the desire to increase local supply chains will lead to long-term demand. Players who choose the EV component that makes the

not only have access to a $6-7 billion market but also have opportunities to expand into global markets and non-auto consumer segments, making the an attractive long-term option.

3: Software and Telematics

Asia Pacific is already the fastest-growing automotive telematics market in the world, with a CAGR of

of approximately 31%. India is the third-largest supplier after China and Japan. The telematics

market in India was estimated at USD4.5 billion in 2021 and is expected to grow at a CAGR of 30% over the next

five years. In addition, the startup market is still emerging.

The top 10 startups represent less than 1% of the total market size. The growth is significant because multiple applications are emerging in predictive and preventive maintenance, driver behavior monitoring, and other vehicle monitoring use cases.

New Age OEMs as the world of as electric cars have evolved, several examples of new, early electric car OEMs have appeared in more mature markets. They challenge and sometimes outperform large automotive incumbents because they are unencumbered by legacy platforms, processes, and channels, which means they can build purpose-built solutions from the ground up. They have also attracted and developed talent and electric vehicle capabilities in critical areas where traditional OEMs are relatively weaker, such as softwareand telematics. The increased tendency of consumers in these segments to experiment with new or challenging

4.Brands have also helped

This dynamic is visible in the 2W and 3W spaces in India, with several new players such as Ampere, Ather, Okinawa, and Ola were early adopters. Participants want to challenge ICE executives like Heron, Bajaj, and TVS to get this space. Both the 2W and 3W EV lineups and market environment will change as the market evolves, and one or more of the new-age OEMs

may become a credible competitor.

5: EV Charging Infrastructure

India’s charging infrastructure is in a very early stage of construction and offers opportunities for participation as the market develops. No one player dominates the market today; rather, there are government agencies.

(e.g., Indian Oil Corporation Limited [IOCL]), OEMs (e.g., Ather Energy and Ola Electric), utilities (e.g., Fortum and Tata Power), and only charging station operators and manufacturers (e.g., Exicom and PlugNgo). to look for a place Such fragmentation, combined with incentives for stakeholder engagement, has created an attractive opportunity for both disruptors and conglomerates. seeking nearby growth opportunities.

Several factors affecting long-term returns are still at play. Considering the relatively small volumes of EVon the market, a viable economic model for operating ,There are no charging stations or battery replacements yet.

There are also some technical challenges that need to be addressed regarding interoperability and standardization. However, since switching to electricity will provide with significant operational savings for consumers, a sustainable model is likely to emerge that allows some of this value to flow over time to charging infrastructure operators to build a sustainable and scalable business

6.Mobility-as-a-Service (MaaS)

The TCO benefits of electric cars coupled with the growing customer preference for green and sustainable solutions will lead to an increase in electric mobility offerings in the Indian market. It includes business-to-business (B2C) e-car services, rental vehicles,

and business-to-business (B2B) mobile services (MaaS) platforms that aim to provide an integrated solution. for fleet operators to electrify their fleets.

The B2B MaaS competitive landscape is relatively nascent, with smaller startups (e.g., Speed,Bounce, Zypp) are testing the model in key e-commerce and delivery markets such as Bangalore building an integrated platform solution for fleet operators through partnerships with OEMs,

financiers and charging point/battery exchange operators. Cracking the sustainable and repeatable given the available resources, a city-level operating model could enable rapid growth and scale base demand growth in these segments and the supposed electric push.

Navigating the New Terrain

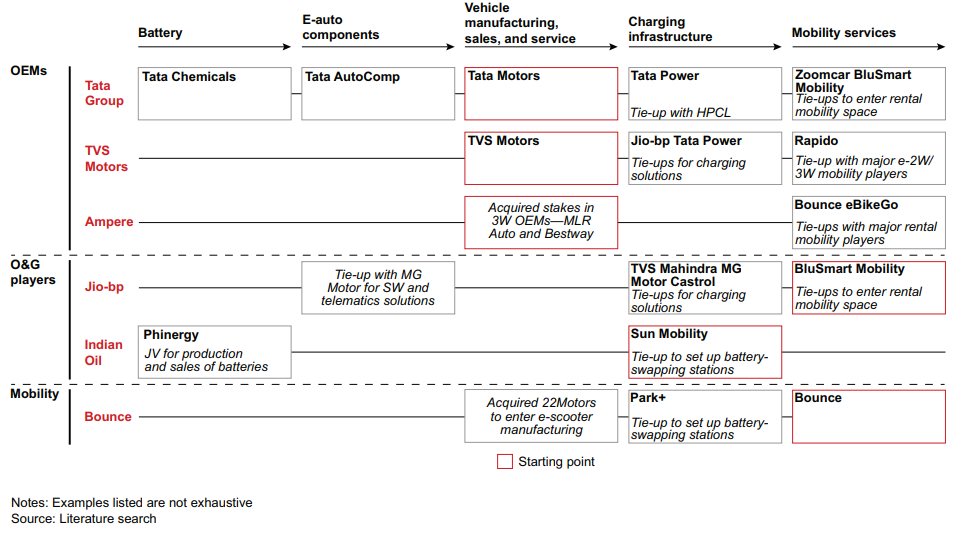

Many participants in EV ecosystems are seeking forward or backward integration using multiple engagement models (build, acquire, or partner) to create a broader e-mobility ecosystem.

Despite the fact that there is a great deal of uncertainty about how the market will develop, there is still room for participants and

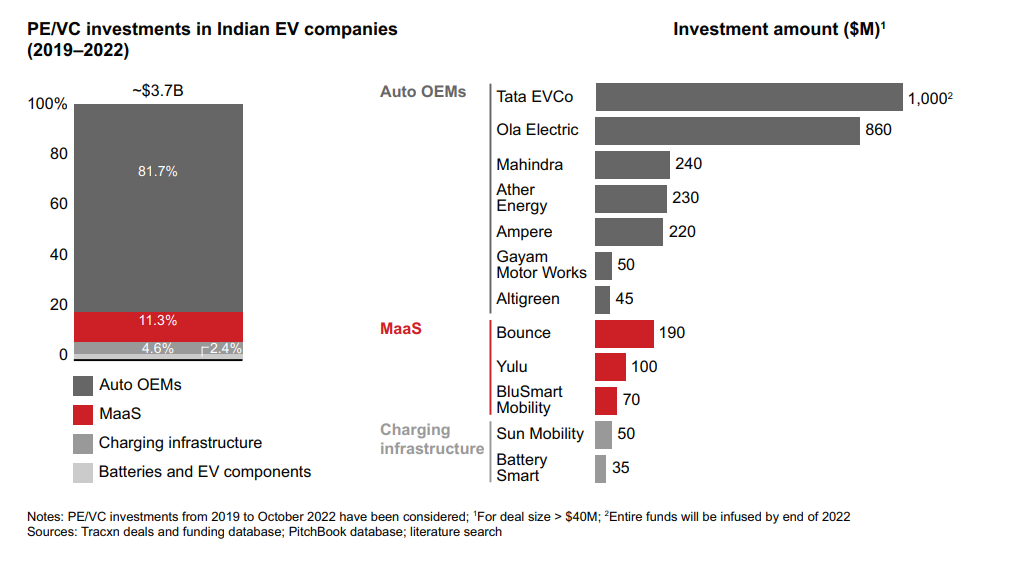

Investors who make the right early bets accumulate significant value. investors have invested $3.7 billion. in equity and venture capital investment in this space in India over the last three years and this number looks set to grow significantly as the industry transforms.

The Indian car market is on the verge of a complete transformation stakeholders with the vision.

Many opportunities exist for those with the ability and flexibility to navigate and differentiate themselves in a rapidly changing landscape.

but lack of a unified agenda for stakeholders Each must calibrate the parts of the profit group they wish to participate in, control, or influence based on their starting points and final goals.

Source: Wef, Bain

Get more news and insights about Global Automobile Industry here