Real estate investors will move into 2023 facing a very different investment landscape than they did at the start of 2022.

Many real estate markets were still strong at this time last year. In 2021, they achieved their highest performance since the Global Financial Crisis (GFC) of 2008, recovering from the weakness related to COVID-19 thanks to subdued demand and particularly buoyant industrial markets.

As 2022 progressed, economic demand combined with external supply disruptions related to the war between Russia and Ukraine led to inflation levels not seen in decades.

The future of property investment has not been so uncertain since the GFC, and this new environment presents many challenges for investors. Overall transaction activity has collapsed as investors pause to reassess the risks they face and are adequately hedged. While it is clear that sentiment is weak, this lull in activity levels means there is little room for reassessment.

As a result, triangulation of various data types and sources is critical. Returns are driven more by the fundamentals of the housing market, which is at a structural turning point in the office market, without the tailwind of declining yields. It is important to understand the interaction of rent growth, occupancy, and costs in different markets and properties.

These factors are just some of the growing number of inputs that can drive assets in an increasingly complex investment environment. The ability to assign risk and return to a growing number of factors, such as yield and rental profile, as well as exposure to more mundane risks such as climate change, is increasingly important to investors.

1) Price expectations are the key to market liquidity.

Commercial real estate investors are focused on the opportunities that asset revaluation will bring as the era of easy money ends. About $3.2 trillion worth of assets were sold in 11 quarters, with the 10-year Treasury yielding less than 2%. Investors in many parts of the world are having to reassess the fundamentals of investing in commercial real estate as the cost of capital rises.

Trading volume is falling globally as investors reassess this investment opportunity. The office market has been particularly affected, with changes in property finance coupled with uncertainty about future demand in key global centres such as London and New York.

Sales activity fell in these key global centres as potential buyers were reluctant to pay yesterday’s limit for acquisitions and wanted to insure against any worst-case scenario for future office demand in any deal. Owners, on the other hand, commit to a final comparable sale, sometimes at pre-pandemic price levels. To restore trading volumes to normal levels, prices would have to fall in both New York and London. We calculate the 29.3 percent change needed for New York offices by October 2022 based on historical trends in investment demand and supply.

Low transaction activity as buyers and sellers diverge on price expectations.

2) Multiple lenses in a rapidly changing market

It is increasingly clear that commercial real estate is in recession, but with the relative opacity of private real estate, it is unclear how far we have to go before we hit bottom. When transaction activity declines in the early stages of a recession, so does the supply of data points and comparable estimates. In such situations, it is especially important to look at the price movement through several lenses.

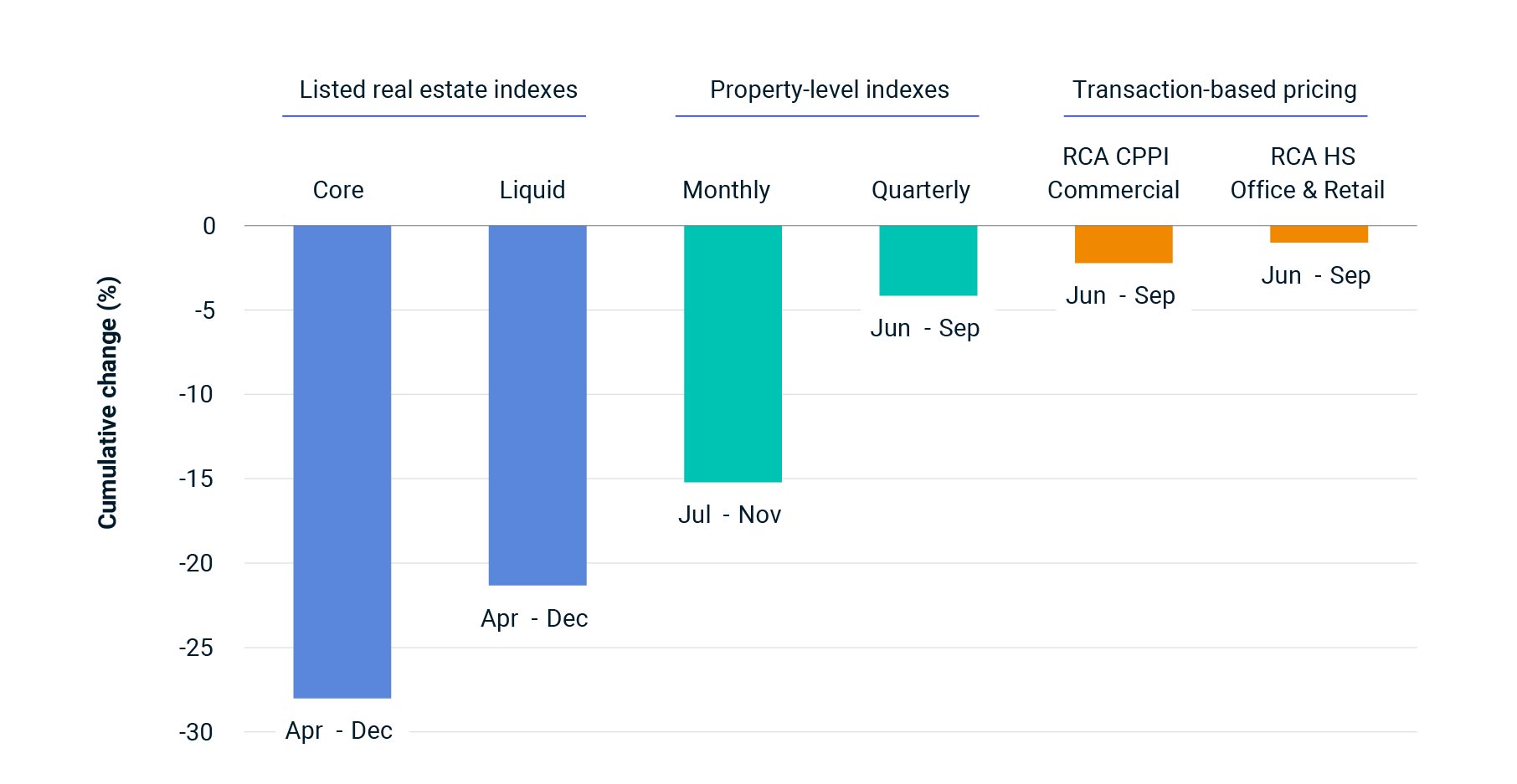

The highest data points, which are the most sensitive to changing market conditions, come from real estate indices quoted on the daily price exchange. The MSCI IMI UK Core Listed Real Estate index is currently showing its deepest decline since the index peaked in April, but the performance is overshadowed by leverage and broader stock market developments. The MSCI UK Liquid Real Estate Index, which adjusts for corporate leverage and attempts to smooth stock market volatility, returned a total return of -22 from April to December 2022.

MSCI real estate indices track performance at the unleveraged asset level. The frequency and timeliness of these rates are determined by assessment practices. The UK is the only market where such an index is available on a monthly basis due to the daily unlimited property sales.

MSCI’s monthly UK index reflects the performance of the assets of such funds and shows continued downward pressure on valuations, with November 2022 marking the fifth consecutive month of negative total return and a cumulative decline of -15.2% from the second quarter. The MSCI UK Quarterly Property Index tracks a much wider sample of properties, but on a quarterly basis, and showed a total return of

in the third quarter.

Transaction figures painted a slightly more muted picture, with UK commercial RCA CPPI falling to just 2.2% in the third quarter after another 1.1% increase. Such indicators reflect the development of real transaction prices, but in an environment of low trading activity, only the best goods often trade and are reflected in such indices.

Many measures of a downturn in UK real estate

Data drawn from the MSCI UK IMI Core Real Estate Index, MSCI UK IMI Liquid Real Estate Index, MSCI UK Monthly Property Index (total return), MSCI UK Quarterly Property Index (total return), RCA Commercial Property Price Index and RCA Hedonic Series.

3. Back to basics: returns without diminishing returns

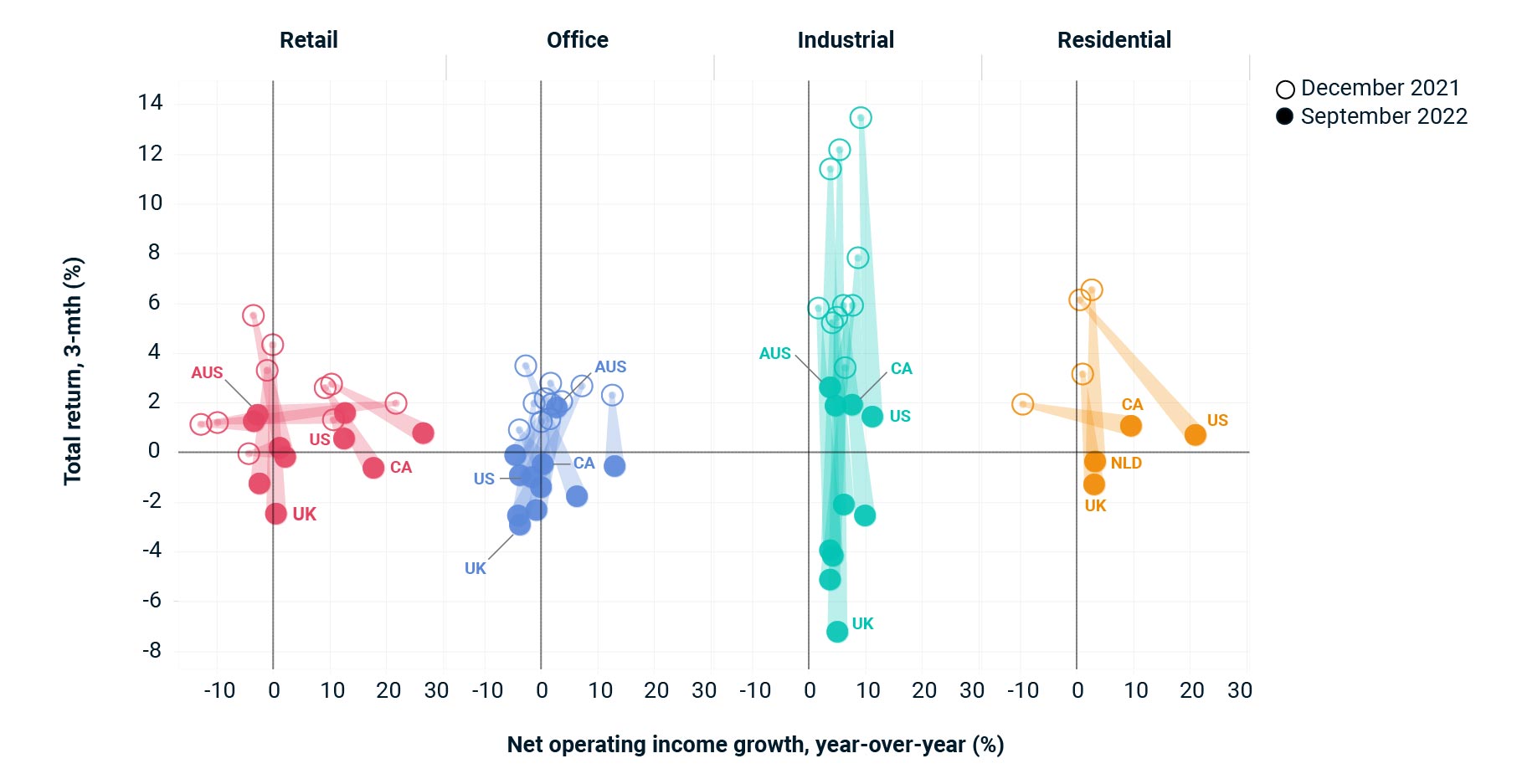

Global real estate returns slowed in the third quarter of 2022 as higher interest rates and inflation combined with slower economic growth weighed on investment returns. This marked a sharp decline from the first quarter, when the MSCI Global Quarterly Property Index recorded its highest annual total return since the pre-GFC period amid a significant decline in returns.

As interest rates have risen in several key global real estate markets, real estate yields have in many cases followed suit, negatively impacting capital growth across sectors and geographies. Industrial real estate, the best-performing sector since the outbreak of the COVID-19 pandemic, saw the largest drop in revenue but remained well positioned in most major global markets, with lower vacancy rates and better net income growth relative to other core sectors.

Development trends observed in 2022 demonstrate how fluctuations in main income can differ from fundamental indicators. Without the leverage of positive returns to boost returns, managers can focus more on tenant retention, managing operating expenses, and increasing rental income to support investment activity. The key is to understand how these fundamentals affect returns in different parts of the market.

Movements in total returns and fundamentals have diverged

Data drawn from The Property Council of Australia/MSCI Australia Annual Property Index, MSCI/REALPAC Canada Quarterly Property Index, MSCI/SCSI Ireland Quarterly Property Index, MSCI Netherlands Quarterly Property Index, MSCI UK Quarterly Property Index, MSCI U.S. Quarterly Property Index and MSCI Europe Quarterly Property Index.

4.Finding Resilience in a Down Market

In a previous study, we used UK data to show how style factors can help property investors better understand and communicate the benefits of their investments. Two of the factors we looked at in this blog post—yield and rental quality—showed cyclical yield trends that can help investors determine how their portfolios are positioned for potential downside.

The chart below shows the historical performance of yield and rental quality in the MSCI UK Quarterly Property Index. The rate of return tended to rise during the risk phase but fall during the de-risk phase.

Rent quality, a factor that looks at rental rate and remaining lease term, has generally produced stronger returns during periods of weaker growth when investors sought income security over income growth potential.

As the real estate market may face a difficult year in 2023, portfolio exposure to these factors can tell us about their potential resilience. The graph on the right shows the exposure of the MSCI UK Quarterly Property Index portfolio to these two factors at the end of September 2022. a portfolio with higher lease quality and lower yield (top left).

5) Climate risk: an abstract concept of economic reality

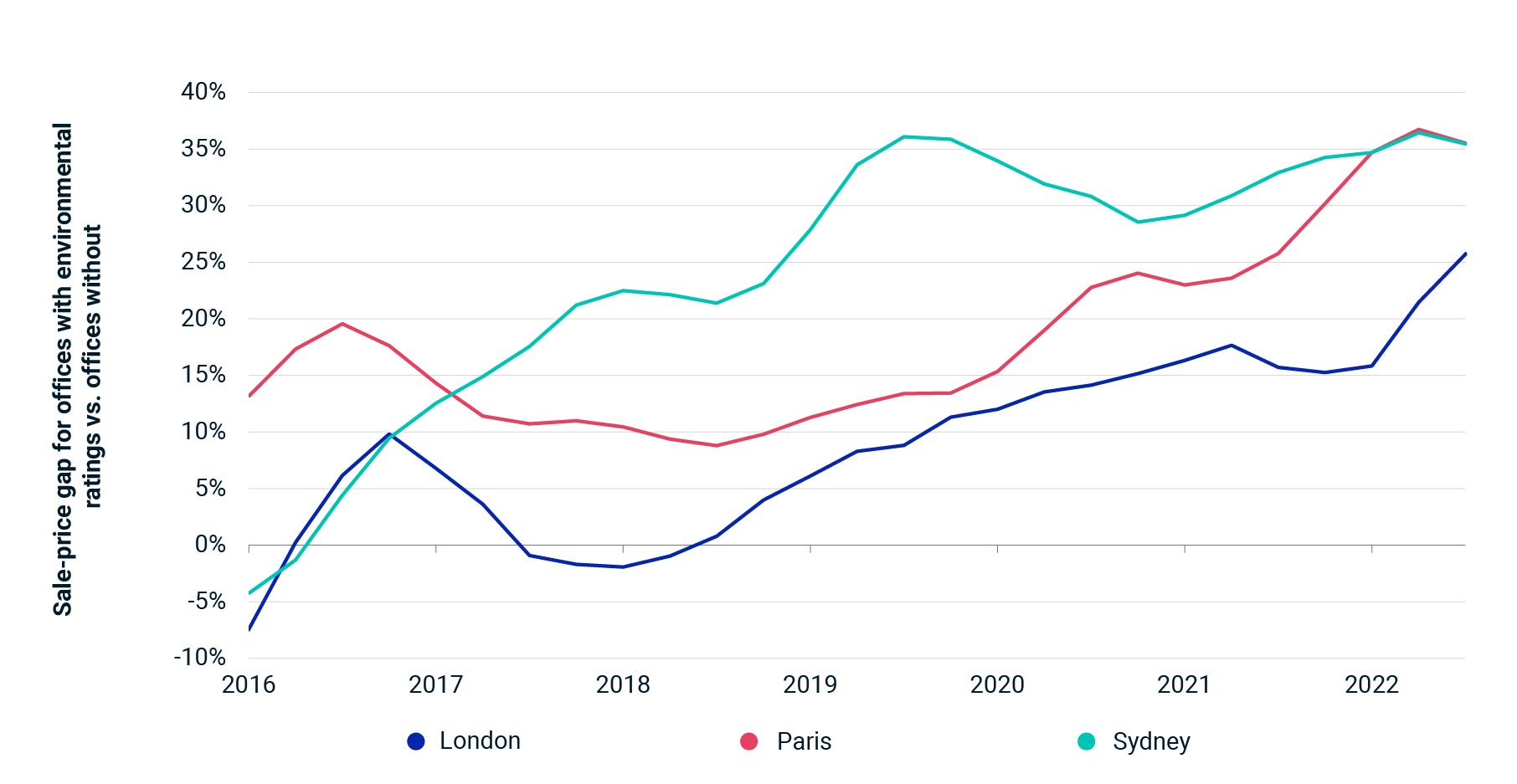

Investors have found it difficult to assess climate risk during their decisions, and many other factors must be taken into account when trading assets. However, our survey of office prices in London, Paris and Sydney shows that buildings with a sustainability rating are recognized by the likes of the Building Research Establishment (BREEAM), GBC Alliance (HQE) and the National Australian Built Environment Assessment System. . and compared to those who have not yet reached these standards.

While the sales price premium associated with environmental assessment has become clear in the transaction market, MSCI’s work on assets in the Netherlands and Norway still does not show that the real emissions of buildings have a definitive effect on efficiency. Reducing emissions from buildings is how the industry will finally deliver real positive change; Therefore, the higher risk to the value of the building caused by high emissions should be considered in the evaluation process due to the transition risk.

The threat of asset rebates encourages owners to make the necessary changes to the building to reduce its emission intensity. It also means that when these assets come to market, they will do so at a price that accurately reflects the level of capital expenditure required to bring them up to standards, whether those climate-related improvements are mandated by legislators or driven by changing market preferences. .

The ‘green premium’ for office assets has been growing in some global cities

London sustainability ratings are based on offices that have either BREEAM or LEED ratings; Paris based on BREEAM, LEED, HQE and BBC certifications; Sydney based on offices with NABERS ratings.

Leave a Reply